How To Find Your Ward And Precinct

In that location are crores of taxpayers filing their income revenue enhancement returns every financial year. The regime has divided these taxpayers into smaller jurisdictions in order to handle the cases meliorate. Read through to know the procedure to find out the jurisdiction yous belong to.

What is income tax ward /circle /range

As said in a higher place, income taxpayers are divided into diverse offices and areas for amend direction. Each income tax officer is assigned a specific area and a specific category of taxpayers. Income revenue enhancement ward and circle are sub-categorisation under an area in club to locate the assigned assessing officer for a particular taxpayer. Range determines the income range of the taxpayer.

Who is an assessing officer

An assessing officer (AO) is a person who is authorised to assess income tax returns filed. If AO finds out any discrepancy in the filed returns, he can outcome a observe to the taxpayer seeking clarification. Assessing officers work from beyond the land for the jurisdiction they are assigned.

What is AO code

AO lawmaking/surface area jurisdiction consists of the surface area code, AO blazon, range lawmaking, and AO number.

Area Code: A code is assigned to every area. You tin discover the area lawmaking based on the area to which your jurisdiction belongs to.

AO Type: It determines the blazon of AO a taxpayer comes under -Type C for circumvolve and Type Due west for the ward. For example, taxpayers with an income above Rs ten lakh will be Type C. Range Code: It says the income range a taxpayer belongs.

AO Number: This denotes the assessing officer number assigned to that particular ward/circumvolve. Such AO code is required to exist quoted in PAN application. Y'all tin can become the information from the income tax section. Alternatively, yous can find this information online.

What is AO code

AO lawmaking varies based on taxpayers' occupation. Individuals in air strength/regular army have specific AO codes as given in the post-obit table:

| Description | Expanse Code | AO Type | Range Code | AO Number | |

| Air Force | ITO Ward 42(2) | DEL | West | 72 | 2 |

| Regular army | ITO Ward four(three), GHQ, PNE | PNE | W | 55 | 3 |

| Applicant Type | Criteria |

|---|---|

| Individuals | For income sources such as: Salary or one of the sources is salary And then, the AO code is based on the role address. |

| Otherwise, the AO code volition be based on the residential address. | |

| Company, local authority, partnership firm, trust, Hindu undivided family (HUF), a torso of individuals, association of persons, limited liability partnership, bogus judicial person, and regime. | AO code volition be based on office address. |

When it comes to people with an occupation other than air force/regular army or organisations, the AO code is determined based on the criteria given in the tabular array below:

Farther, the AO code may change over fourth dimension according to the changes in the income tax policies. Contact the local income tax part to notice out the AO assessing your case.

How to find out your income revenue enhancement ward (Method i)

You tin can determine the jurisdiction you belong to by post-obit the steps given beneath:

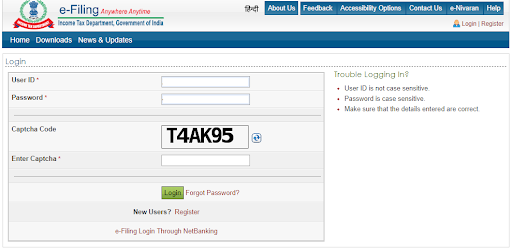

Footstep 1: Visit the income tax e-filing portal at www.incometaxindiaefiling.gov.in.

Step 2: Click on 'Verify Your PAN Details' option on the left-side carte du jour as shown in the epitome below.

Step 3: Enter the necessary information such equally PAN, full name, date of nascence, and the type of taxpayer every bit shown in the image below.

Step 4: Click 'Submit'.

Stride 5: You will receive an OTP on your registered mobile number. Enter the OTP on the screen and click 'Submit'.

Pace 6: A screen will be displayed with the details – PAN, first name, middle name, surname, citizenship status, jurisdiction, and remarks (if the PAN status is agile or not).

Finding income revenue enhancement ward (Method two)

Step one: Log in to the income tax e-filing portal at www.incometaxindiaefiling.gov.in.

Step 2: Click 'My Profile' under the 'Profile Settings' tab.

Footstep 3: Click on the 'PAN' tab to get the necessary details of your jurisdiction.

File your income revenue enhancement for Costless in 7 minutes

Complimentary, simple and accurate. Designed by tax experts

Source: https://cleartax.in/s/locate-it-ward-no-circle-range-ao-code-online

Posted by: alleneaunded1981.blogspot.com

0 Response to "How To Find Your Ward And Precinct"

Post a Comment